Kenya not at risk of defaulting – Mbadi dismisses Nyoro’s claims on debt as irresponsible

While admitting that Kenya has encountered fiscal challenges, the CS maintained that the nation’s debt position remains sustainable.

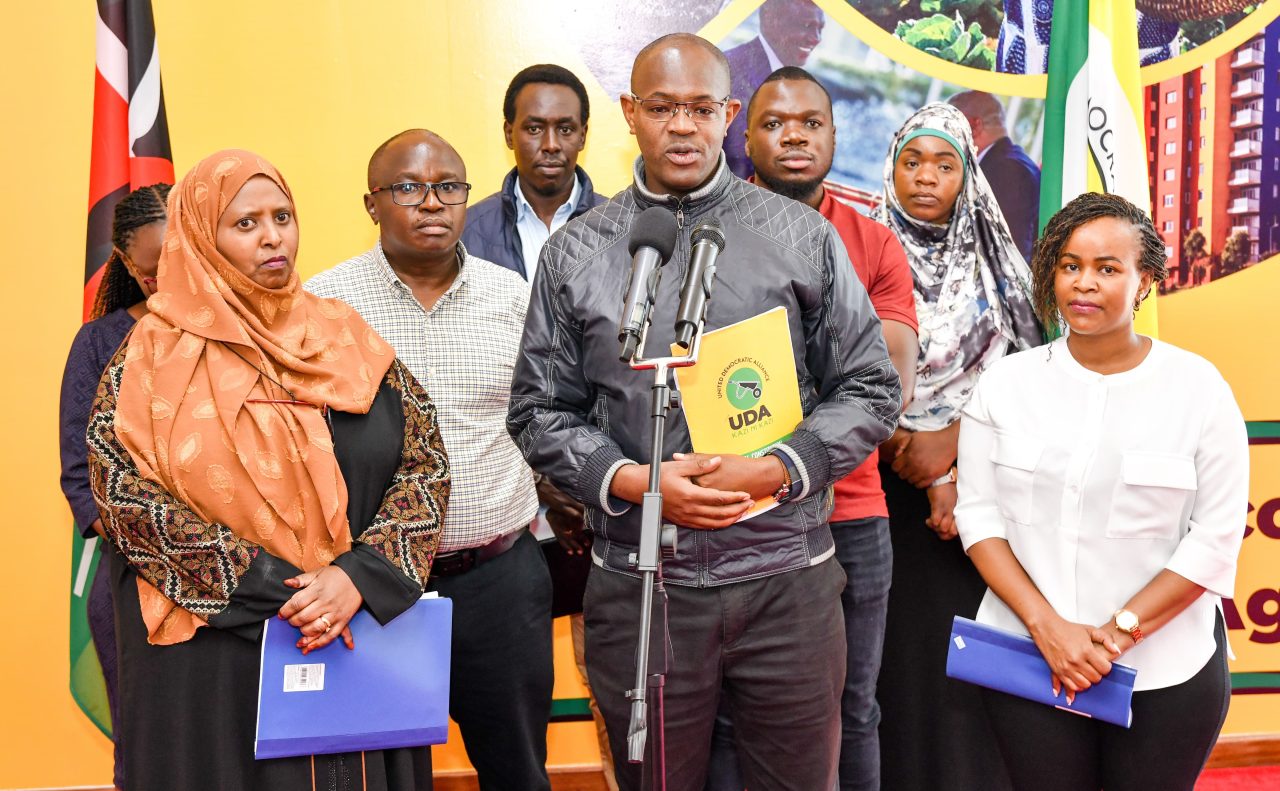

Treasury Cabinet Secretary John Mbadi has refuted claims by former Budget and Appropriations Committee Chairperson Ndindi Nyoro that Kenya is on the brink of defaulting on its debt obligations.

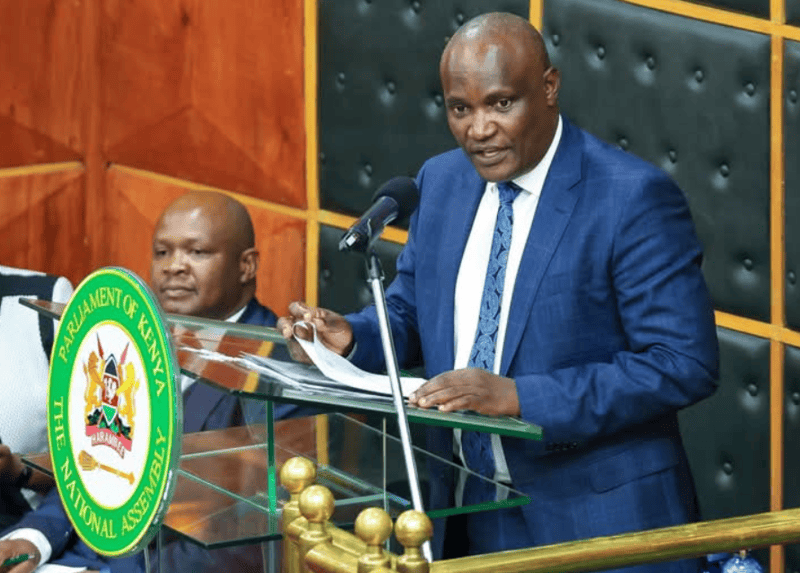

Appearing before Parliament on Wednesday, Mbadi acknowledged that the country is experiencing liquidity pressures due to the maturation of previously acquired loans. However, he firmly stated that Kenya is not facing a debt sustainability crisis.

More To Read

- Salaried workers to bear high PAYE burden as Treasury shelves tax relief plan

- Mbadi, Miano make new appointments across ministries

- Sh218bn budget shortfall threatens education, health and elections

- Funding crisis looms over universities, TVETs as HELB and exam budgets slashed

- Government clears Sh118.3bn pending bills in Q1 2025 as Treasury pushes to cut arrears

- Senate threatens censure motions against CSs Mbadi, Wahome, Kinyanjui over snubbed summons

“I listened to one of us claim that this country is likely to default on debt repayments. That is an irresponsible statement. It can cause unnecessary panic and should not come from someone who has chaired the Budget and Appropriations Committee,” said Mbadi.

“Regardless of differences, we remain leaders of this country. I urge caution in our public pronouncements—we are all privileged to serve, and with that comes responsibility.”

While admitting that Kenya has encountered fiscal challenges, the CS maintained that the nation’s debt position remains sustainable.

“Yes, there have been difficult moments. But as it stands, our debt is sustainable. The figures are publicly available—both the International Monetary Fund (IMF) and World Bank have reviewed them. We have been rated internationally,” he said.

Mbadi explained that Kenya’s main challenge lies in liquidity, arising from the timing of loan maturities.

“The issue is cash flow. Loans were contracted at specific times, and many are maturing between now and 2032. That’s where the pressure is. But after 2032, if you review our books, which are public, you will find that from 2034 to 2048, there is hardly any external debt to repay—whether bilateral, commercial, or multilateral.”

He called for cooperation among all arms of government in navigating the country’s current fiscal pressures.

“Between now and 2032, we must act in concert—this House, the Treasury, the Executive. That is why some of us were appointed to the Executive as experts—to steer the economy in the right direction,” he said.

“Let us not derail this process. I remain committed. There is no scenario in which Kenya will default on its loans. We remain the strongest economy in the region, and such unfounded fears only damage public confidence.”

Mbadi also defended the government’s fiscal record, citing the consistent disbursement of salaries, school capitation funds, and allocations to counties.

“Yes, we may be under strain, but have we defaulted on paying salaries? No. Have we failed to disburse capitation to schools? We have paid in full. Are security and other essential services being funded? Yes.”

Mbadi’s remarks follow comments by Kiharu MP Nyoro, who on Tuesday warned that Kenya risks joining the list of African debt defaulters due to its rising public debt levels.

Speaking at the Institute of Public Finance’s annual budget review forum, Nyoro described Kenya’s debt—estimated at Sh11 trillion—as “worrying”, and cautioned against debt restructuring efforts.

“Any signal suggesting we may default or are unable to service our loans would be catastrophic for the economy,” he said.

According to the Central Bank of Kenya, as of December 2024, the country owed Sh10.9 trillion, with 54 per cent owed to domestic lenders and 46 per cent to foreign creditors.

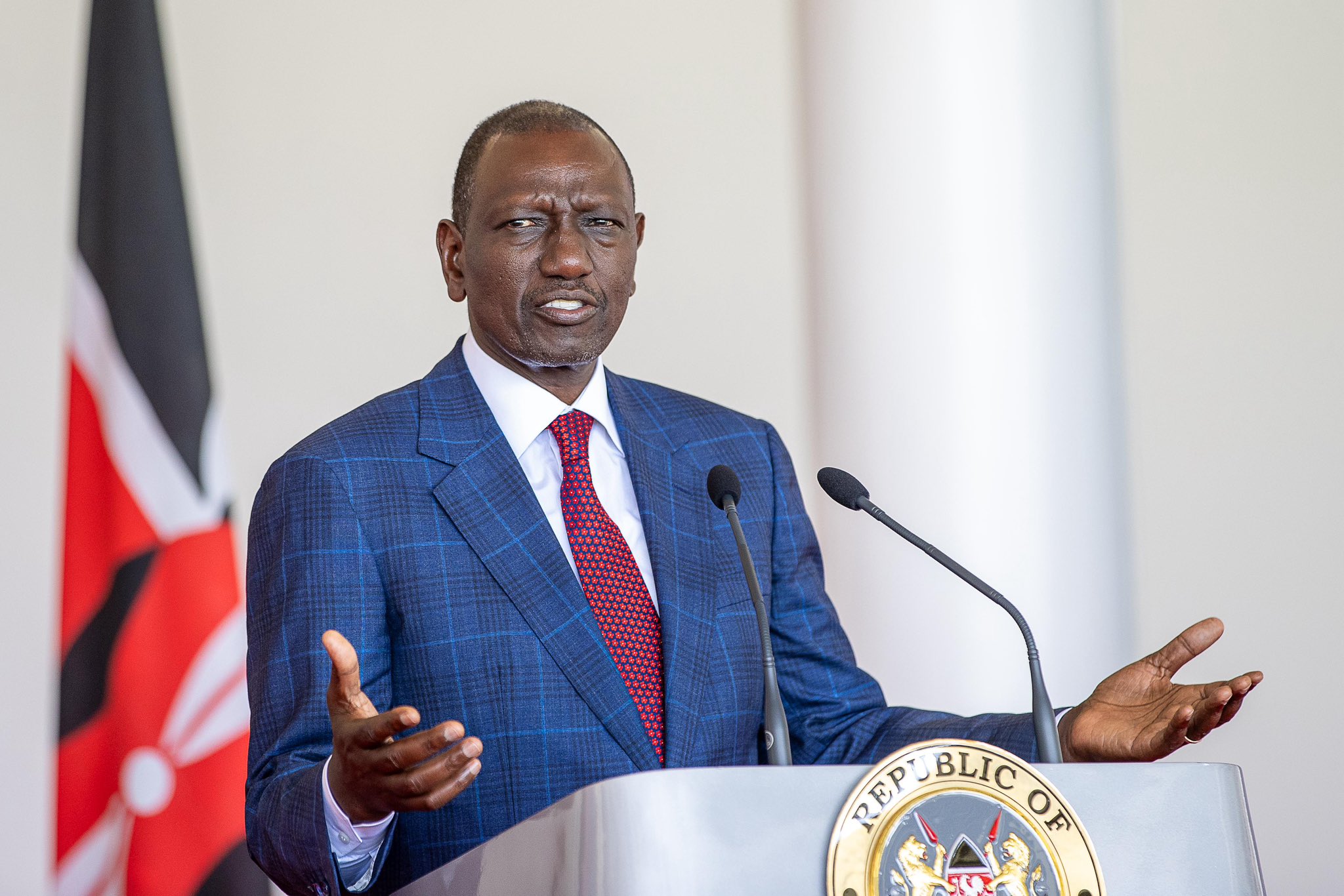

Since President William Ruto took office, public debt has increased from Sh8.7 trillion to over Sh11 trillion.

As the Treasury prepares the 2025/26 budget, the government projects expenditure of Sh4.2 trillion, with approximately Sh1 trillion earmarked for interest payments.

Nyoro estimated Sh750 billion would go towards servicing domestic debt, with Sh200 billion set aside for external repayments. He attributed Kenya’s growing debt burden to excessive taxation and economic hardship.

“Increasing taxes to raise revenue is misguided. It distorts economic decisions. If I had planned to buy a car, I would now hold off because the government is targeting my income. This reduces even the limited revenue the government might have collected,” he said.

Nyoro also cited Kenya’s ongoing engagements with China as indicative of the country’s efforts to restructure its debt, warning that such moves point to a heightened risk of default.

President Ruto is expected to visit China soon, with speculation suggesting that debt discussions will feature on the agenda.

Top Stories Today